Executive Compensation at the Air Line Pilots Association (2020)

The Airline Pilots Association International (ALPA) is the largest airline pilot union in the world with more than 61,000 pilots from 38 US and Canadian airlines. Based in McLean, Virginia, ALPA is a tax-exempt, non-profit 501 (c) (5) whose membership dues are approximately $3,600 annually (based on 1.9% of gross income which appears to be about $200,000 annually).

In 2020, ALPA reported total revenue of $226 million (compared to $235 million in 2019 which indicates despite the effects of COVID on airline travel, the revenue stream continued from members), most of which came from membership dues. Expenses totaled $154 million (including nearly $4 million in depreciation) with the largest expense reported to be compensation.

339 employees received $68 million in compensation which equates to an average compensation of $200,000. 229 employees received more than $100,000 in compensation with the 25 most highly compensated reported to be:

- $1,389,366: Joseph DePete, President

- $ 704,146: David Krieger, General Manager

- $ 680,027: Jonathan Cohen, Chief Counsel/Director, Legal

- $ 683,672: Bruce York, Sr Advisor & Chief Negotiator

- $ 621,426: Elizabeth Ginsburg, Director of Representation

- $ 517,448: Elizabeth Robinson, Director of Finance/CFO

- $ 532,443: Marcus Migliore, Sr Managing Attorney

- $ 505,591: Kelly Collie, Director, HR

- $ 491,817: Arthur Luby, Asst Dir of Representation

- $ 523,359: Howard Hagy, Director, Engineering and Air Safety

- $ 487,470: Marie Schwartz, Dir of Strategic MBR Dev and Resources

- $. 494,544: Andrew Shostack, Asst Dir of Representation

- $ 487,040: David Weaver, Dir, Communications

- $ 473,763: Thomas Ciantra, Managing Attorney

- $ 431,986: Elizabeth Baker, Dir of Gov’t Affairs

- $ 454,903: Richard Harrell, Dir, Info Tech and Services

- $ 398,566: Kyle Johanning, Director, Economic and Financial Analysis

- $ 360,582: John Schleder, Sr Labor Relations Counsel/MEC Coordinator

- $ 380,892: Randy Kenagy, Mgr, Engineering and Operations

- $ 388,498: Andrea Griffith, Comptroller

- $ 390,875: Catherine Powers, Managing Attorney

- $ 376,208: Lee Veid-Norstern, Mgr, IT Development and Support

- $ 370,815: Jane Schraft, Sr Labor Relations Counsel/MEC Coordinator

- $ 279,087: Steve Hodgson, Manager, Retirement and Insurance (retired)

- $ 248,671: Lori Garver, Former General Manager

The 25 employees listed above received $14 million in compensation. 17 of the 25 (68%) employees are male while 8 of the 25 (32%) are female (note: Gender is not reported on a Form 990. Conclusions were made based on name and google searches).

The most highly compensated employee, Joseph DePete received more than $1.4 million in 2020 and $5 million in compensation from 2017-2020:

- 2020: $1,389,366

- 2019: $1,305,050

- 2018: $1,381,738

- 2017: $1,188,806

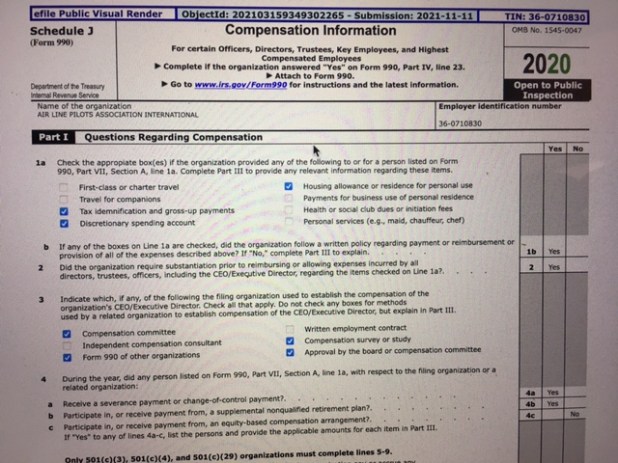

ALPA paid a housing allowance or for a residence for personal use. Specifically, an officer who maintains a primary residence outside of the Washington, DC area is reimbursed for appropriate housing, meals, and incidental expenses while in the Washington, DC area and transportation between his/her primary residence outside the Washington, DC area.

ALPA paid a housing allowance or for a residence for personal use. Specifically, an officer who maintains a primary residence outside of the Washington, DC area is reimbursed for appropriate housing, meals, and incidental expenses while in the Washington, DC area and transportation between his/her primary residence outside the Washington, DC area.

ALPA provided discretionary spending accounts. Specifically, the “national” officers receive a monthly payment for reimbursement of extraordinary expenses, both business and personal.

ALPA has a supplemental non qualified retirement plan. Additional taxable compensation related to a 457F non qualified deferred compensation plan was reported for Mr. Joseph DePete in the amount of $538,250, Steven Hodgson in the amount of $92,805, and Ana McAhron-Schultz in the amount of $102,823.

26 independent contractors received more than $100,000 in compensation. The 5 most highly compensated were reported to be:

- $5,323,508: Coakley Williams Construction Co, of Bethesda, MD for construction

- $2,587,794: Virtual Flight Surgeons, of Centennial, CO for aeromedical advisors

- $1,494,809 : Home Front Communications, of Washington, DC for marketing/advertising

- $ 961,418: INFOR 100003566, of Minneapolis, MN for software

- $ 814,682 : Kelly Press, Inc., of Cheverly, MD for printing

To read the IRS Form 990 (2020), click here.

Comments are closed.

I will take a look at City of Hope.

Thank you for this. Also interesting is that they have Federal oversight and disclosures through LMDRA. I am also interested in OLMS and the companies NOT reporting anti-union activity. Do you have any information on City of Hope? https://www.cityofhope.org/ I am interested in nonprofit health and charter school education as well.