Executive Compensation at CalTech

The California Institute of Technology (CaTech) is a private research university focused on science and engineering. Based in Pasadena, CA, CalTech has about 2,500 students (1,000 undergraduate and 1,500 graduate) whose predecessors have been awarded 46 Nobel Prizes. Tuition, room and board total about $90,000 annually. According to the school’s website, 51% of students receive an average need based assistance of $60,000. Only 27% of students graduate with loans and the average indebtedness is $17,000.

CalTech houses and manages NASA’s Jet Propulsion Laboratory (JPL) – a federally funded research and development center – and consequently counts the federal government as its largest source of revenue. Revenue and expenses are not delineated between JPL and education on the Form 990.

Total revenue was $3.6 billion in 2022 with most revenue from JPL (federally funded by NASA) and awards ($2.6 billion), government grants ($337 million), investment income and gains ($254 million), contributions ($219 milli0n) and tuition ($155 million).

Expenses totaled $3.4 billion in 2022 with the largest expenses reported to be compensation ($1.9 billion), contract services ($816 million), office-related expenses ($493 million), and grants ($117 million) – primarily to individuals. 1,875 students received $117 million in cash grants, or an average of $62,000 each.

CalTech’s expenses were about $200 million less than total revenue (and historically, expenses have been less than revenue), which means the school does not need to charge $90,000 annually for tuition, room, and board. Caltech took in $155 million in tuition and awarded $117 million in cash grants suggesting that full pay students are subsidizing the education costs of those qualifying for need-based financial aid.

CalTech ended the year with $3.8 billion in net assets– a decline of about $600 million primarily due to unrealized losses on investments that were partially offset by the excess revenue in 2022.

11,656 employees received $1.9 billion in compensation, an average of $163,000. 6,205 employees received more than $100,000 in compensation with the 22 most highly compensated reported to be:

- $2,673,947: Scott H Richland, Chief Investment Officer

- $2,283,897: Thomas F Rosenbaum, President/Trustee

- $1,162,816: Patsy Isabellą Wang, Sr Mgr, Director of Investments

- $ 930,593: Kirk Kawasawa, Sr Managing Director, Investment Ops

- $ 841,676: Douglas N MacBean, Mgr Director of Investments

- $ 792,616: Edward M Stopler, Professor, Former Provost

- $ 791,411: Dexter A Bailey, VP, Adv and Alumni Relations

- $ 769,972: David A Tirrell, Provost

- $ 765,887: Michael M Watkins, Professor, Aerospace and Geophysics

- $ 743,216: Larry Dean James, Interim Director, JPL (until 5/22)

- $ 729,509: Jennifer T Lum, General Counsel

- $ 672,670: Margaret Steurbaut, Former VP, Admin and CFO (until 9/21)

- $ 517,258: Cathy A Light, Secretary, Board of Trustees

- $ 498,876: Diana Jergovic, VP, Strategy Implementation

- $ 476,447: Sharon E Patterson, Associate VP for Finance and Treas

- $ 462,461: Sammy A Kayali, CFO and Manager, Lab Operations

- $ 410,650: Marc J Goettel, Former Director of Business Ops, JPL

- $ 369,670: Joseph E Shepherd, Former VP, Student Affairs

- $ 364,505: Matthew W Brewer, Controller

- $ 357,566: Kevin M Gilmartin, VP, Student Affairs

- $ 301,080: Carol J Schull, EA to Pres/Asst Secretary (until 1/22)

- $ 236,896: Arturo Aguayo, Assistant Treasurer

The 22 most highly compensated employees received $17 million in 2022. 15 of the 22 (68%) most highly compensated employees are male while 7 of the 22 (32%) are female. 9 of the 10 most highly compensated employees are male. These 10 employees received $46 million from 2017-2022 (note: highly compensated employees employed 2017-2021 but not in 2022 are not included in the list below):

Scott H Richland: Total Compensation 2017-2022; $10.5 millin

- 2022: $2,673,947

- 2021: $1,380,926

- 2020: $2,035,910

- 2019: $1,828,695

- 2018: $1,559,026

- 2017: $1,126,209

Thomas F Rosenbaum: Total Compensation 2017-2022: $8.5 million

- 2022: $2,283,897

- 2021: $1,510,231

- 2020: $1,378,803

- 2019: $1,209,385

- 2018: $1,142,842

- 2017: $1,092,219

Pasy Isabellą Wang: Total Compensation 2017-2022: $6 million

- 2022: $1,162,816

- 2021: $1,087,486

- 2020: $1,231,916

- 2019: $1,101,350

- 2018: $ 928,500

- 2017: $ 702,390

Kirk Kawasawa: Total Compensation 2021-2022: $1.5 million

- 2022: $930,593

- 2021: $542,949

Douglas N MacBean: Total Compensation 2020-2022: $2 million

- 2022: $841,676

- 2021: $788,674

- 2020: $569,548

Edward M Stopler: Total Compensation 2017-2022: $4 million

- 2022: $792,616

- 2021: $536,930

- 2020: $561,494

- 2019: $557,408

- 2018: $678,026

- 2017: $701,159

Dexter A Bailey: Total Compensation 2020-2022: $2 million

- 2022: $791,411

- 2021: $772,066

- 2020: $419,181

David A Tirrell: Total Compensation 2018-2022: $3 million

- 2022: $769,972

- 2021: $752,626

- 2020: $704,206

- 2019: $623,258

- 2018: $461,681

Michael M Watkins: Total Compensation 2017-2022: $4.5 million

- 2022: $765,887

- 2021: $897,673

- 2020: $868,162

- 2019: $778,294

- 2018: $739,563

- 2017: $340,400

Larry Dean James: Total Compensation 2017-2022: $4 million

- 2022: $743,216

- 2021: $669,256

- 2020: $654,910

- 2019: $641,441

- 2018: $630,212

- 2017: $596,180

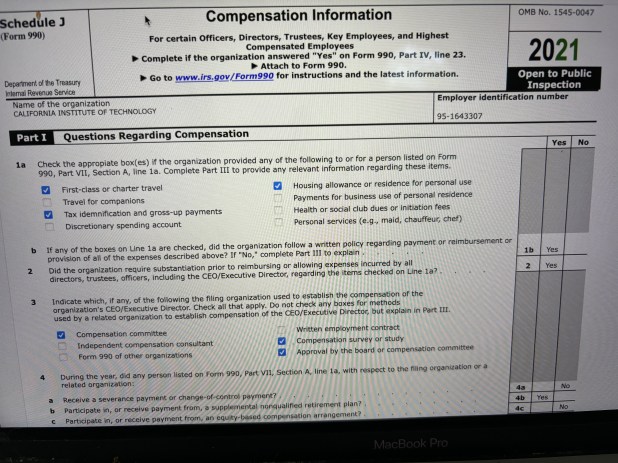

CalTech paid for first class or charter travel, made gross up payments or provided tax indemnification and provided a residence for personal use or provided a housing allowance. To read more details about these expenses and deferred compensation, see the Form 990, Schedule J, Part III, Supplemental Information. To read about “transactions with interested persons,” see the Form 990, Schedule L, Part IV.

CalTech paid for first class or charter travel, made gross up payments or provided tax indemnification and provided a residence for personal use or provided a housing allowance. To read more details about these expenses and deferred compensation, see the Form 990, Schedule J, Part III, Supplemental Information. To read about “transactions with interested persons,” see the Form 990, Schedule L, Part IV.

1,047 independent contractors received more than $100,000 in compensation. The 5 most highly compensated were reported to be:

- $91 million: Applied Physics Laboratory, of Laurel, MD for research and development

- $70 million: Ball Aerospace Technologies, of Chicago, IL for aerospace

- $59 million: Columbus Technologies and Services, of El Segundo, CA for info technology

- $58 million: Mantech Advanced Systems, of Fairfax, VA for information technology

- $47 million: Peraton, Inc, of Herndon, VA for info technology

To read the IRS Form 990 (2021 for the year ending September 30, 2022), click here.

Comments are closed.